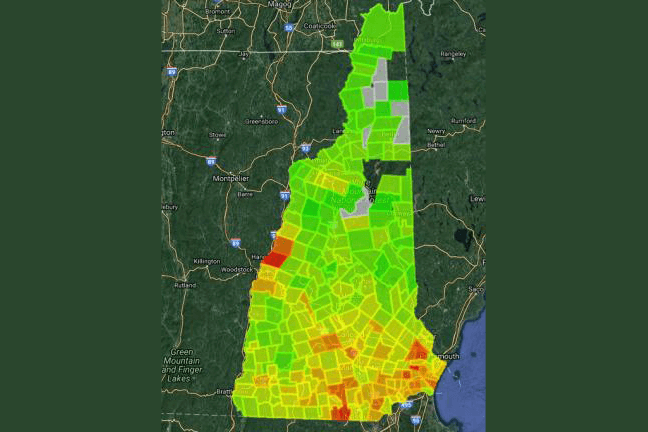

Property tax rates vary widely across New Hampshire, which can be confusing to house hunters. In Claremont, for example, the property tax rate is $41 per $1000 of assessed value, while in Auburn, it’s only around $21 per $1000 of assessed value. Why such a wide range? Well, the answer to that question is complicated, and there are several factors to consider about property taxes before choosing a home.

Property tax rates vary widely across New Hampshire, which can be confusing to house hunters. In Claremont, for example, the property tax rate is $41 per $1000 of assessed value, while in Auburn, it’s only around $21 per $1000 of assessed value. Why such a wide range? Well, the answer to that question is complicated, and there are several factors to consider about property taxes before choosing a home.

Schools, Infrastructure and City Services

It’s important to understand that a town’s property tax rate is not necessarily an indicator of the quality of its schools, infrastructure or city services. Auburn, for example, has a low tax rate and uses the schools in Derry, a very desirable district.

The school portion of the town budget typically accounts for 60-75% of the property tax burden. Towns with good schools and lower tax burdens include Auburn, Alton, Rye, and Wolfeboro. Towns with colleges or universities (Henniker, Keene & Durham, to name a few) typically have relatively high taxes.

Big Government

High taxes = big government. Often, high taxes correlate to an oversized local government.

Assessed Rate

While a high tax rate may be undesirable, a particular property may have a low assessed rate. The assessed rate (determined by the town and not by the list price of the home) determines the total tax burden: Property taxes = tax rate x assessed value. A high tax rate shouldn’t necessarily disqualify a particular town from your list.

Resources to consult: Tax rates map or spreadsheet, tax amounts map (which take into account assessed value) and home prices.

Property tax rates tend to increase gradually over time with the biggest increases coming from things like the construction of new schools or fire stations, or other general capital improvements to the town.

Saving on Property Taxes

One way to save money on property taxes is through tax credits. These vary widely from town to town, but some of the available credits can include credits for US military veterans, credits for senior citizens, and credits for those who are handicapped. Not every town offers these and the discounts tend to be small, but it’s worth a call to your town’s tax assessor office.

When house hunting, it’s important to remember to look at each property as the sum of its parts, and not just look at one data point like property taxes.